Accident Medical

Accident Medical Insurance covers medical bills—including fees from hospital stays, emergency treatment, medical exams, and other associated expenses—resulting from an injury on the premises. Without the proper protection, medical bills can quickly add up and become a significant expense

LEARN MORE

Amateur Sports

Although the sports and recreation industry provides people with fun experiences that put smiles on their faces, it also comes with plenty of risks. Given the physical nature of the industry, the chances of a customer suffering a bodily injury are high. Sports and Recreation insurance protects businesses from the costs of a lawsuit because of a bodily injury.

LEARN MORE

Community Association

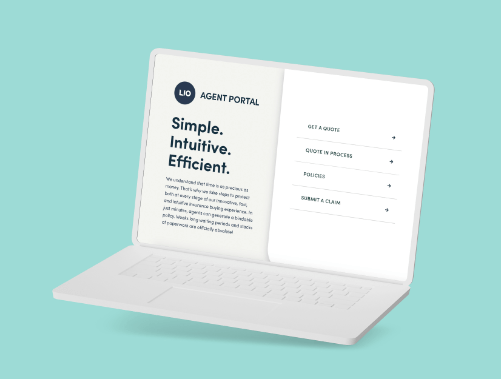

Our state-of-the-art, digital portal allows agents to easily locate, purchase, and manage specialized condominium and homeowner associations insurance policies. Weeks-long waiting periods and stacks of paperwork are officially obsolete. In just minutes, agents can generate a bindable policy.

LEARN MORE

Miscellaneous Professional Liability

Miscellaneous Professional Liability protects businesses from costly mistakes that cause financial harm to clients—whether it’s an overlooked detail, a misstatement, or a misunderstanding. But risks don’t stop there. The world is unpredictable—and so are your clients’ needs. Stay protected with flexible coverage, quickly bindable and backed by expert underwriters.

LEARN MORE

Nonprofit Management Liability

Specifically designed for Nonprofit organizations, LIO’s Nonprofit Management Liability includes Directors & Officers, Employment Practices Liability, Fiduciary and Workplace Violence coverage.

LEARN MORE

Nonprofit and Social Service Organizations

Nonprofit and Social Services organizations represent the best of America. They provide a way for people to work together for the common good, transforming shared beliefs and hopes into action. For many social, educational, religious, literary, and charitable causes, we’ve designed a customizable and comprehensive insurance solution so they can focus on pursuing their missions.

LEARN MORE

Special Events

Special Event insurance offers easy and affordable, short-term coverage for a wide variety of events. Whether it’s a business conference, festival, concert, or parade, our policy is designed so you can live in the moment and enjoy the day!

LEARN MORE

Underwriting Contact

Out with the old, in with a faster, more flexible, and digitally-supercharged way to select, buy, and manage specialized insurance coverage.